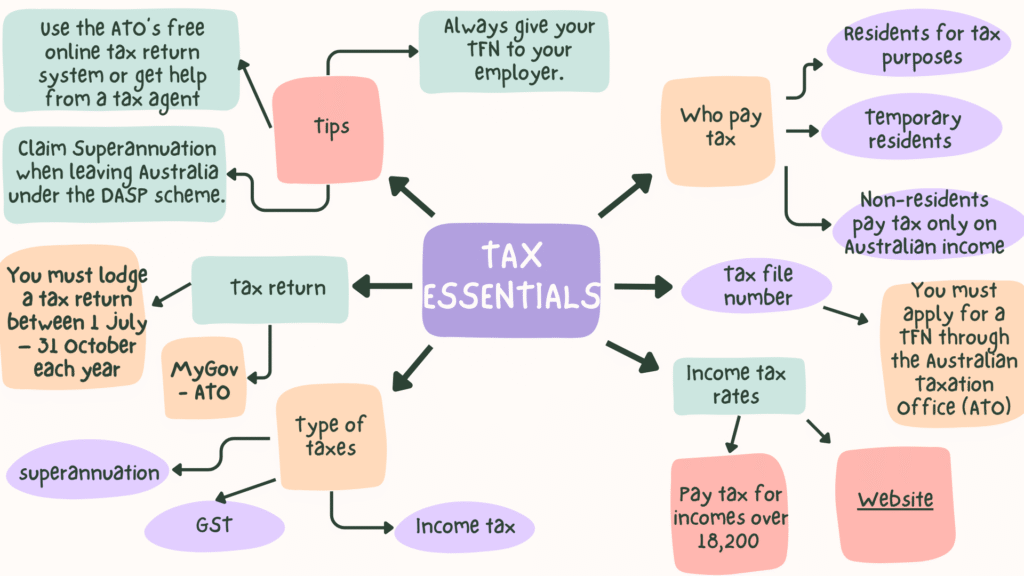

If you are living, studying, or working in Australia, it’s important to understand how the tax system works. Paying tax is part of everyday life, and knowing the basics will save you stress and sometimes even help you get money back at the end of the financial year.

Most Foreigners who stay in Australia for more than six months are considered residents for tax purposes. This means you are required to pay tax on the income you earn in Australia, just like locals. Even if you are a temporary resident on a student visa or work visa, you still need to pay tax on any Australian income. Non-residents only pay tax on Australian-sourced income, but they usually face higher tax rates and don’t get the tax-free threshold.

To work legally in Australia, you will need a Tax File Number (TFN). This is a personal identification number issued by the Australian Taxation Office (ATO). Your employer and bank will ask for your TFN, and if you don’t provide one, you may end up paying much higher tax. Applying for a TFN is free and can be done online through the ATO.

The tax you pay depends on how much you earn during the financial year, which runs from 1 July to 30 June. Residents do not pay any tax on the first $18,200 they earn. After that, income between $18,201 and $45,000 is taxed at 19 percent. If you earn between $45,001 and $135,000, the tax rate is 30 percent, while higher incomes are taxed at 37 or 45 percent. On top of this, most residents also pay a 2 percent Medicare levy, which goes toward Australia’s healthcare system. Some international students may not be required to pay this levy, depending on their circumstances.

TAXABLE INCOME (AUD) | TAX RATE | EXPLANATION |

| $0 – $18,200 | 0% | Tax-free threshold |

| $18,201 – $45,000 | 19% | 19% for income above $18,200 |

| $45,001 – $135,000 | 30% | 30% for income above $45,000 |

| $135,001 – $190,000 | 37% | 37% for income above $135,000 |

| $190,001 and over | 45% | 45% for income above $190,000 |

Aside from income tax, there are other taxes and contributions you will come across. The Goods and Services Tax (GST) of 10 percent is already included in most shop prices, so you don’t usually notice it directly. Another important contribution is superannuation, often called “super.” Your employer must pay 11 percent of your earnings into a retirement fund for you. If you are a temporary resident, such as a student or worker, you can claim this superannuation back when you permanently leave Australia, although some tax will be deducted.

Every year, between July and October, you need to lodge a tax return. This is where you report your income, tax paid, and any deductions or offsets you can claim. Many Mongolians are surprised to find out they often get a refund because too much tax was taken from their pay during the year. You can lodge your return online through myGov → ATO or with the help of a registered tax agent.

For Foreigners living in Australia, the key things to remember are simple: always apply for a TFN, give it to your employer, and keep records of your income and work-related expenses. Even if you are only working part-time while studying, you may still need to lodge a return. If you are leaving Australia permanently, don’t forget to claim your superannuation back under the Departing Australia Superannuation Payment (DASP) scheme.

The Australian tax system might seem complicated at first, but it is well-organized and designed to be fair. As long as you know your responsibilities and lodge your tax return on time, you will stay compliant — and you may even look forward to tax season when that refund arrives. For more detailed information, always check the official Australian Taxation Office (ATO) website.